Save on Storm Insurance in Bell with Tree Health Reports

Tree Health Assessment Bell

Bell, California, homeowners are discovering that professional tree health assessment reports can significantly reduce storm insurance premiums while protecting their properties from expensive weather-related damage. As insurance companies increasingly recognize the value of proactive tree maintenance in preventing costly claims, certified arborist assessments have become powerful tools for securing insurance discounts and demonstrating responsible property management.

Understanding Tree Health Assessment Insurance Benefits

Risk Reduction Documentation

Insurance companies assess many types of risk when evaluating homeowners’ insurance policies, and one of the largest types of risk is the risk of damage from fallen trees. Performing a comprehensive tree health assessment allows property owners to document that they are actively managing and reducing their tree-related risk, which can be used to obtain significant premium discounts.

Each professional tree health assessment will evaluate the structural weaknesses of each tree on your property, any diseases affecting your trees, and/or environmental factors that may be stressing your trees, causing them to be at greater risk of failing during a storm. When you take proactive steps to address these issues, you demonstrate to your insurance company that you are a responsible property owner engaged in risk management, which will be rewarded through lower premiums and expanded coverage options.

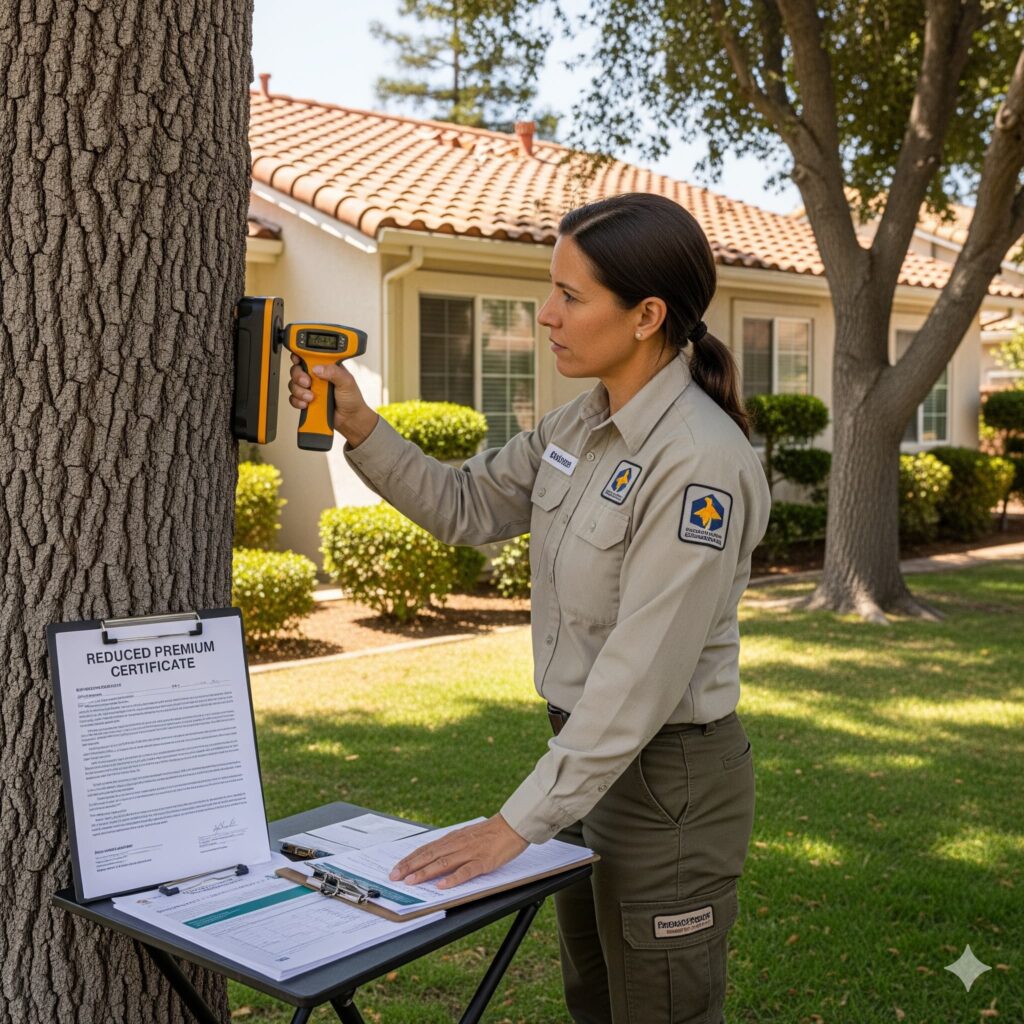

Your professional tree health assessment report(s) will serve as documentation of the maintenance of your property and provide proof that you are actively engaged in mitigating any potential damages that may be caused by your trees. This documentation will prove invaluable when you file an insurance claim and will clearly show that you were actively engaged in maintaining your property versus being negligent.

Preventative Maintenance Documentation

In recent years, more and more insurance providers have begun offering discounts to homeowners whose property has been properly maintained and inspected by a qualified arborist. As part of this inspection, a tree health assessment will create verifiable records of your property’s maintenance that will aid in obtaining discounts and assist in the claims process.

Providing documentation of your preventative maintenance will help to protect you from having to pay for damage that was preventable had you performed routine inspections and maintenance on your trees. Many insurance companies view damage to your property that could have been prevented through proper maintenance as a lack of responsibility by the homeowner and will, therefore, deny the claim.

Your professional assessment reports will also allow you to track the condition of your trees over time and will enable you to demonstrate to your insurance company that you are continually monitoring your trees for potential hazards and taking action to mitigate those hazards. This long-term documentation will assist in establishing a positive working relationship with your insurance company and will possibly qualify you for additional coverage options.

Professional Tree Health Assessment Process

Comprehensive Property Evaluation

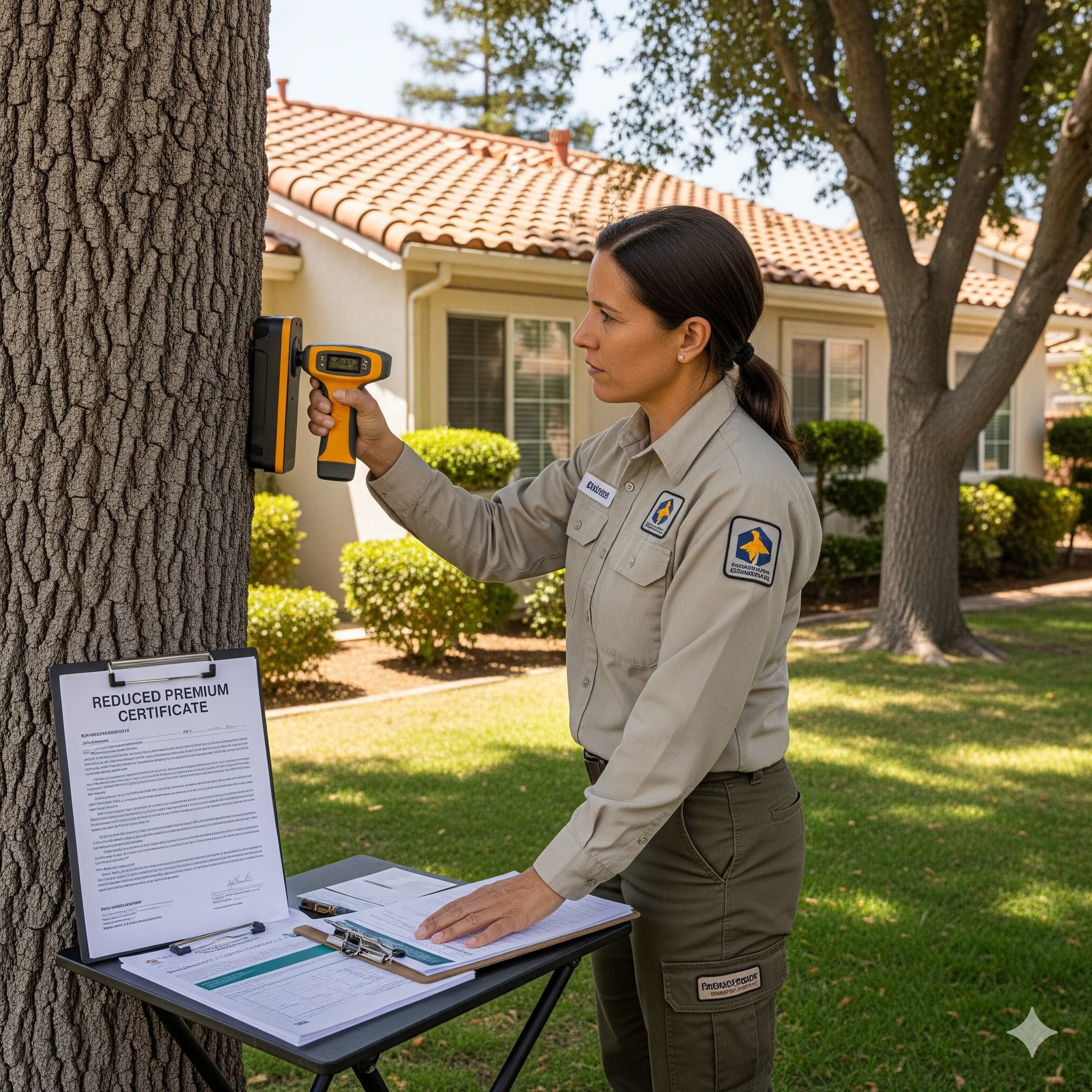

Certified arborists will perform a comprehensive evaluation of all trees on your property, assessing each tree’s structural integrity, health conditions, and environmental factors that could influence its stability. The comprehensive nature of this assessment will ensure that every possible hazard is identified and documented for insurance purposes.

Each tree will be evaluated using a variety of methods, including visual inspections, measuring the diameter and circumference of trunks and stems, and evaluating the root system of each tree. Specialized equipment and techniques will be employed to identify structural defects in the trunk and branches of the trees that may not be visible to the untrained eye but could result in catastrophic failure during extreme weather events.

Arborists will also evaluate the environmental conditions at each site, including soil quality, water table, sunlight exposure, and the presence of nearby power lines, buildings, etc. All of these environmental factors will be assessed to help determine how each tree will behave during different weather conditions and what specific risk factors need to be addressed.

Detail Risk Assessment Documentation

Your tree health assessment report will contain extensive documentation of the condition of each tree on your property, including photographs, measurements, and professional recommendations for any needed pruning, watering, fertilizing, thinning, removing, or other treatments. This documentation will provide your insurance provider with the information necessary to accurately assess the risk associated with each of your trees.

This documentation will include an assessment of immediate risks to public safety and property damage and will also identify potential future problems. The comprehensive nature of the report will enable you to prioritize your maintenance investments while providing your insurance provider with the specific information they need regarding your risk management efforts.

Your professional report will also include specific recommendations for addressing any issues identified during the assessment, along with a timeline and estimate of costs. Demonstrating a proactive plan for addressing any issues identified will further demonstrate your commitment to risk management and will be rewarded by your insurance provider through lower premiums and expanded coverage options.

Species-Specific Health Analysis

As an urban forest, Bell has a wide diversity of tree species, each with its own specific health requirements and risk profile. Your professional tree health assessment will provide a species-specific analysis of each of the tree species present on your property, identifying specific vulnerabilities and maintenance needs for each species.

Bell is home to several common tree species, including Coast Live Oaks, Citrus trees, Eucalyptus trees, Palm trees, and several others, each with its own structural characteristics and health requirements. Your professional assessment will ensure that your maintenance recommendations address the specific needs of each tree species while managing overall property risk.

Your professional assessment will also consider how the different species on your property interact with each other and their environment, and will identify potential scenarios where the failure of one tree may cause damage to other trees or create a chain reaction of damage. This comprehensive approach will provide your insurance provider with complete information regarding your property’s risk assessment.

Insurance Premium Reduction Strategies

Proactive Risk Management Programs

Homeowners who demonstrate a commitment to ongoing risk management through their actions and decisions will be rewarded by their insurance company through reduced premiums and expanded coverage options. Your tree health assessment will serve as the foundation for a comprehensive risk management program, which will ultimately lead to significant savings on your insurance costs.

Typically, a documented risk management program will include regular professional assessments of your trees, prompt maintenance of your trees based on the recommendations provided by your arborist, and ongoing monitoring of your trees. By showing your insurance company that you are committed to preventing claims instead of just reacting to problems once they arise, you will be rewarded through increased premium savings.

Some insurance companies currently offer discounts of 5 to 15 percent to homeowners with documented tree maintenance programs. Some carriers are now offering significantly larger discounts to homeowners with documented risk management programs that demonstrate exceptional risk management through comprehensive assessment and maintenance programs.

Liability Reduction Documentation

Your professional tree health assessment will assist in reducing your liability by identifying and addressing potential hazards before they cause damage to neighboring properties. This proactive approach to maintaining your property will protect you from potential lawsuits related to tree damage while demonstrating to your insurance company that you are a responsible property owner.

Your liability documentation will be especially important in urban environments like Bell, where property owners are very close to each other, and tree failure could affect multiple properties. Your professional assessment report will provide evidence that you have taken reasonable precautions to prevent damage to neighboring properties.

Your insurance company may offer you additional liability coverage or lower liability premiums if you have documented tree health management programs in place. Additional liability coverage will provide you with additional peace of mind while providing you with the possibility of lower total insurance costs.

Benefits of Claims Prevention

Your greatest savings will be achieved by preventing claims altogether through the active management of your tree health. Properties with regular assessment and maintenance programs will experience less storm damage to their trees, resulting in lower overall insurance costs over time.

Your claims prevention benefits go far beyond the premium savings associated with not submitting a claim. They include: maintained claims-free discounts, lower deductibles, and continuing eligibility for preferred coverage options. If you submit too many claims, you may find yourself facing increased premium rates or coverage restrictions that can be avoided through proper tree health maintenance.

Insurance companies monitor your claims history when deciding whether or not to renew your policy, so investing in tree health assessment and subsequent proactive maintenance is a long-term investment in achieving lower insurance costs. Properties that do not submit claims will have improved relationships with their insurance providers and be eligible for competitive pricing.

Precision Tree Services Bell: Complete Assessment Programs

Certified Arborist Evaluations

Precision Tree Services Bell offers comprehensive tree health assessment programs that will support your insurance discount applications and risk management programs. Our certified arborists are knowledgeable about the insurance companies’ requirements for receiving premium reductions and will provide you with the documentation required to apply for and receive the discounts.

We will thoroughly evaluate all of the trees on your property, focusing on the types of trees that are common in the area around Bell landmarks, such as Veterans Memorial Park, Ernest Debs Park, and in residential areas. Our knowledge of the unique challenges of growing trees in Bell’s Mediterranean climate will ensure that our assessments address the specific risks of each tree type on your property.

Our assessment reports will include detailed recommendations for your maintenance priorities based on the urgency and potential damage of each issue identified during the assessment. This priority-based approach will help you to strategically invest in your maintenance while maximizing the amount of insurance benefits you receive.

Insurance Grade Documentation

We will provide you with insurance-grade documentation that meets the specific documentation requirements of the major insurance companies that serve homeowners in the Bell area. Each report will include all of the technical information necessary to evaluate the risk posed by each of your trees, photographic evidence, and professional certifications.

Each report will include a detailed assessment of the condition of each tree, specific maintenance recommendations based on the recommendations made by your arborist, a timeline for completion of recommended repairs, and a risk assessment that quantifies the potential for damage to people and property. This comprehensive documentation will provide your insurance company with all of the information they need to evaluate your risk reduction efforts.

We also offer ongoing consultation and assistance to help you maintain your insurance company’s requirements and maximize the available discounts. Our long-term partnership approach will ensure that the investments you make in tree health assessments will continue to yield benefits for years to come.

Customized Risk Management Plans

While our standard tree health assessment services will provide you with a comprehensive overview of the risks associated with the trees on your property, we also offer customized risk management plans that address the unique needs of each Bell property and maximize your insurance benefits.

These customized risk management plans will incorporate your tree health management into your overall property maintenance strategy to achieve comprehensive risk reduction. Each plan will include:

- Preventive maintenance schedules for your trees.

- Emergency response plans for tree failure.

- Ongoing monitoring programs to detect potential hazards early and provide you with the opportunity to correct them before they become more severe.

- Specific recommendations for your trees and your property.

- Assistance in communicating with your insurance company to ensure that your plan meets their specific requirements for premium discounts and expanded coverage options.

We will work with your insurance company as necessary to confirm that your customized risk management plan meets their requirements for premium reductions and expanded coverage options. This cooperative approach will provide you with maximum insurance benefits while protecting your trees and your property.

Benefits of Storm Damage Prevention

Structural Integrity Monitoring

By regularly assessing and maintaining the structural integrity of your trees, you will be able to identify and correct structural weaknesses that could lead to catastrophic failure during Bell’s severe weather events (Santa Ana winds and atmospheric river storms). Identifying and correcting these structural weaknesses will save you from the costly storm damage and the hassle of dealing with your insurance company.

Your structural integrity monitoring will focus on evaluating your trees’ root systems, trunk conditions, and branch attachments that are most susceptible to failure during high wind events. Through the use of advanced technology and techniques, your arborist will be able to identify structural defects in your trees’ trunks and branches that may not be visible to the untrained eye but could result in catastrophic failure during extreme weather events.

Your monitoring program will also allow you to track the changes in your tree’s condition over time, allowing you to take proactive measures to correct any structural weaknesses before they reach a point where they could result in catastrophic failure. This proactive approach to maintaining the structural integrity of your trees will eliminate the necessity for costly emergency tree removal and damage to structures, vehicles, and neighboring properties.

Weather-Specific Risk Assessment

Because of Bell’s location in Southern California, your trees are exposed to specific weather-related stresses, including drought, high winds, and occasional heavy rainfall. Your professional tree health assessment will evaluate how local weather patterns affect different tree species and will identify specific vulnerabilities.

Your professional assessment will consider how different tree species respond to seasonal stress patterns, such as summer drought stress and winter storm loading. This analysis will allow you to prepare your trees for the seasonal challenges they will face while reducing the risk of storm damage.

Your professional assessment will also evaluate site-specific factors that affect how your trees respond to severe weather, including soil conditions, drainage, and exposure to prevailing winds. Your professional assessment will provide your insurance company with a detailed analysis of the actual risks associated with your property.

Emergency Preparedness Planning

Your professional tree health assessment will support the development of comprehensive emergency preparedness plans by identifying potential failure points and developing strategies for responding to emergencies before they occur.

Your proactive planning will not only minimize your costs for storm damage but will also demonstrate your commitment to risk management to your insurance company.

Your emergency preparedness planning will include:

- Identifying trees or branches that need to be removed before storm season;

- Developing evacuation routes that avoid potential tree failure areas;

- Establishing relationships with emergency tree services to quickly respond to your property in the event of a storm;

- And developing communication protocols with your insurance company to quickly process your claim following a storm event.

Having established relationships and documentation will simplify the claims process and will help to ensure that your storm-related damage is properly covered under your insurance policy.

Long-Term Financial Benefits

Premium Savings Accumulation

Your investments in tree health assessments will generally pay for themselves within 2-3 years through the savings in your insurance premiums, with continued savings accumulating over time.

Properties with documented tree maintenance programs will generally realize premium reductions that compound over time, thereby increasing your total savings.

Your premium savings will accumulate through multiple means, including base rate reductions, maintained claims-free discounts, and eligibility for preferred coverage options. Your total savings will generally exceed the initial costs of the tree health assessment by a large margin over time.

Additionally, the long-term savings in your premiums will also provide you with the financial flexibility to invest in ongoing tree maintenance investments, thus creating a self-sustaining cycle where your savings fund future risk-reducing investments.

Protecting Property Values

Your professional tree health management will help to protect your property values by maintaining healthy mature trees that contribute to the attractiveness of your property and the character of your community.

Well-maintained trees near Bell landmarks and in residential areas will increase your property values and lower your insurance costs by reducing the likelihood of storm damage.

Property value protection extends beyond individual properties to include neighborhood-wide benefits from comprehensive tree management. Areas with well-maintained urban forests command higher property values while experiencing lower insurance costs due to reduced storm damage risks.

Investment in tree health assessment also prevents costly emergency tree removal and property damage that can negatively impact property values. Proactive management maintains the aesthetic and functional benefits of mature trees while avoiding the disruption and expense of emergencies.

Risk Management Investment Returns

The results of a tree health assessment represent an investment in long-term risk management with returns resulting in lower insurance premiums, avoided property damage, and preserved property value. The various benefit streams of assessment programs make them a very cost-effective tool for managing risk.

Investment returns consist of both direct monetary returns (insurance premium reductions) and indirect returns (avoided costs associated with emergency tree removal, repairs for property damage, etc.) and/or liabilities for damages to others. Combined returns on assessment investments can be substantial.

In addition to financial returns on investment, risk management investments provide emotional returns or “peace of mind” that are less quantifiable but still very important to property owners. The knowledge that a property owner’s trees are being properly maintained and that any potential hazards are identified will reduce a property owner’s stress and uncertainty when a severe weather event occurs.

Implementation Strategy for Bell Homeowners

Scheduling and Planning Assessments

Timing for the optimal performance of a tree health assessment schedule coincides withthe insurance company’s renewal cycle for maximum premium reduction benefits. Most insurance companies assess risk factors once per year; therefore, it is best to submit annual assessment reports to ensure continued discount eligibility.

In addition to timing, consideration should also be given to seasonal conditions that impact tree condition evaluations. Fall/Winter assessments provide the most complete picture of a tree’s structural integrity before the start of the storm season. Spring assessments can evaluate a tree’s recovery from winter weather conditions and help identify new maintenance requirements.

Additionally, scheduling assessments should be incorporated into overall property maintenance plans to ensure that recommended tree maintenance activities coincide with other landscaping projects and budgetary considerations. By coordinating all aspects of maintenance, the time required to perform maintenance activities can be minimized and ensure that all maintenance requirements are met as soon as possible.

Coordinating with Insurance Providers

Successful implementation of this program requires working with insurance providers to determine what specific requirements they have regarding documentation needed to obtain premium discounts, and to ensure that assessment reports meet their documentation requirements. Insurance companies vary greatly in regard to their requirements for documenting risk management activities.

Early coordination with insurance providers can help ensure that assessment reports contain all the required information necessary for discount applications. Additionally, some insurance companies may require certification by a licensed arborist, specific documentation formats, or specific maintenance commitments to be eligible for premium reductions.

Ongoing communication with insurance providers can assist in maintaining discount eligibility and may also identify additional opportunities for premium reductions through implementing additional risk management programs. Developing good relationships with your insurance provider can also help you receive recommendations to maximize insurance benefits.

Integration with Long-Term Maintenance Programs

A tree health assessment establishes the foundation for long-term maintenance programs that will continue to provide insurance premium reductions while maintaining the optimal health of trees. Integrating tree health assessments with ongoing landscape maintenance practices will ensure that the recommended work is done promptly and properly documented.

Long-term maintenance integration includes establishing working relationships with qualified tree service professionals who understand the insurance industry’s requirements and can document the maintenance performed on your trees to allow for continued discount eligibility. Establishing a network of professional service providers will help ensure that maintenance activities meet both tree health and insurance requirements.

Additionally, long-term maintenance integration includes incorporating tree health management into your budget planning so that your property continues to participate in the risk management programs required for continued insurance premium reductions. By making this type of planning a part of your long-term strategy, you will be able to successfully manage tree health risks over time.

A professional tree health assessment is one of the most effective ways to reduce the cost of storm-related insurance premiums and protect Bell properties from weather-related damage. Tree health assessments can create comprehensive documentation, promote long-term maintenance planning, and provide numerous financial benefits to homeowners.